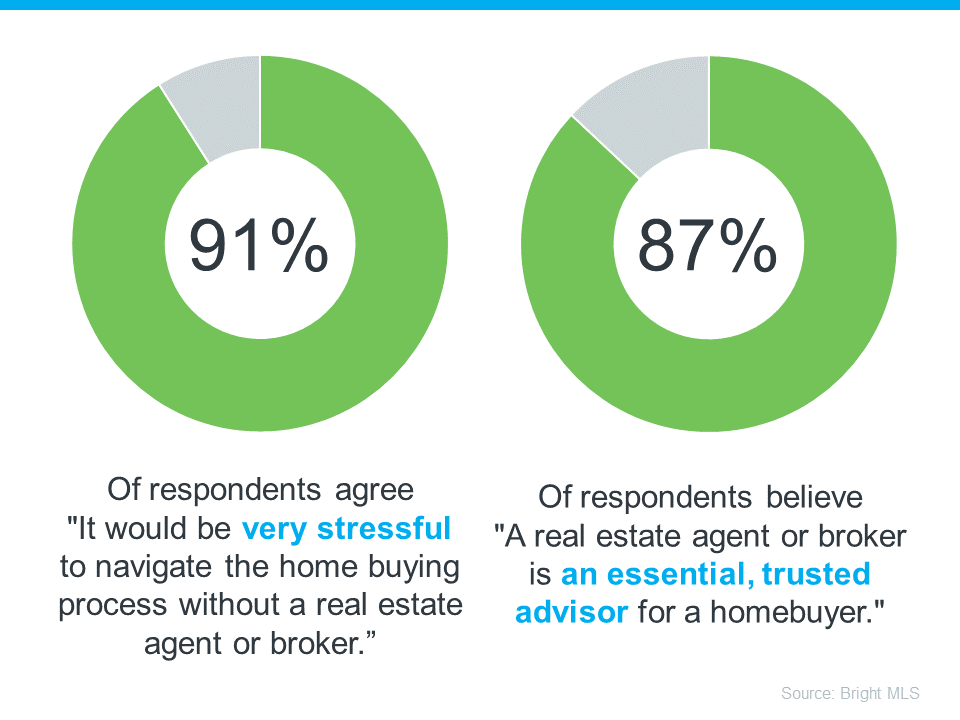

You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing. But here’s the thing you really need to know – expert advice from a trusted real estate agent is priceless, now more than ever. And here’s why.

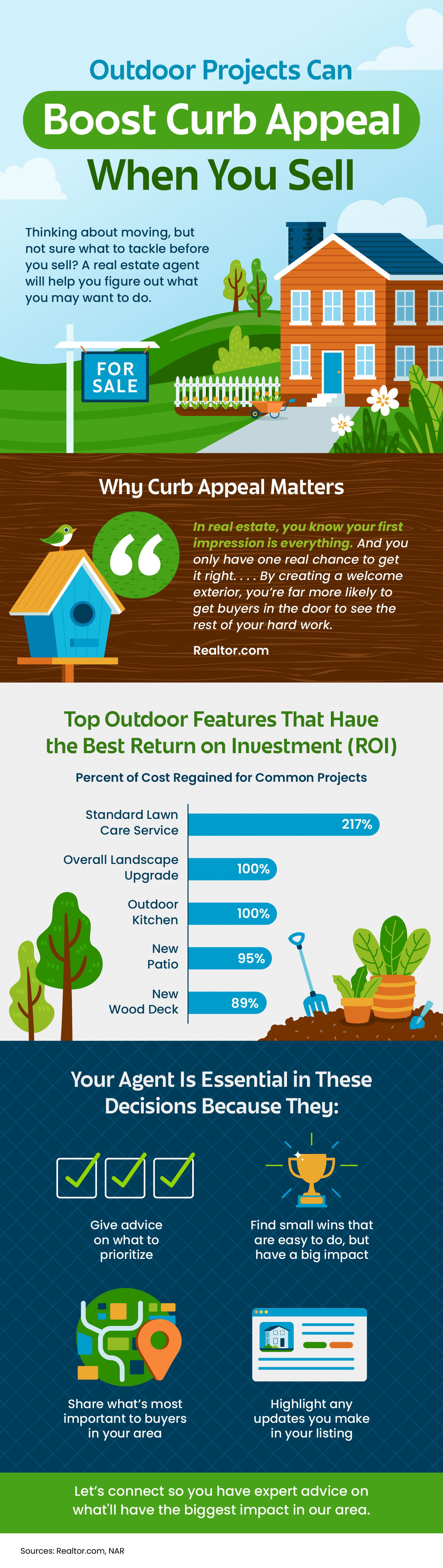

A real estate agent does a lot more than you may realize.

Your agent is the person who will guide you through every step when buying a home and look out for your best interests along the way. They smooth out a complex process and take away the bulk of the stress of what’s likely your largest purchase ever. And that’s exactly what you want and deserve.

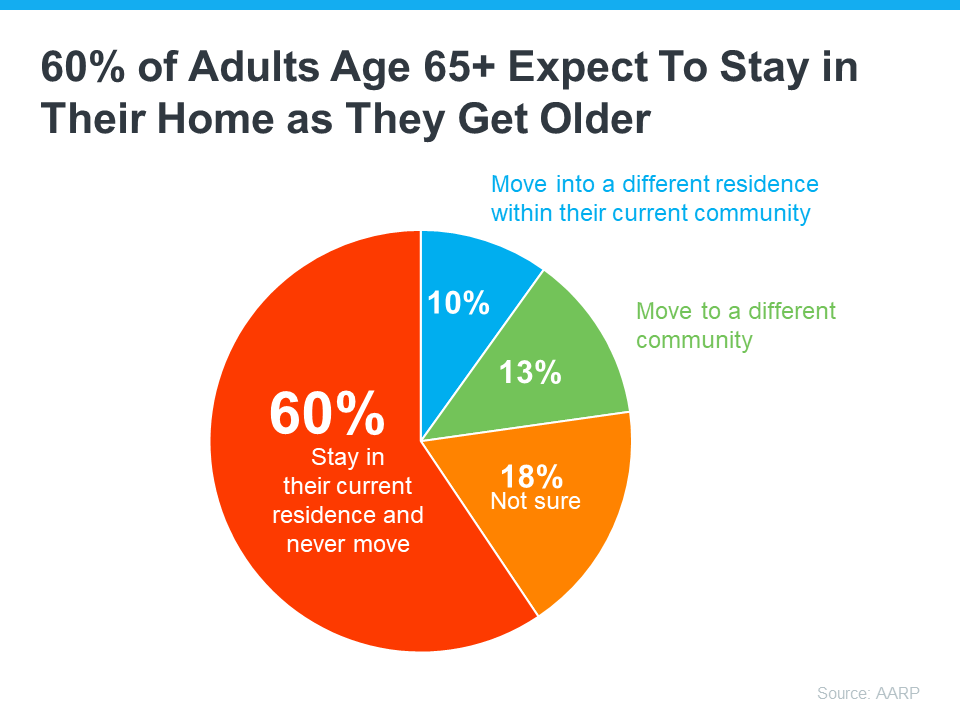

This is at least a part of the reason why a recent survey from Bright MLS found an overwhelming majority of people agree an agent is a key part of the homebuying process (see visual below):

To give you a better idea of just a few of the top ways agents add value, check out this list.

1. Deliver Industry Experience

The right agent – the professional – will coach you through everything from start to finish. With professional training and expertise, agents know the ins and outs of the buying process. And in today’s complex market, the way real estate transactions are executed is constantly changing, so having the best advice on your side is essential.

2. Provide Expert Local Knowledge

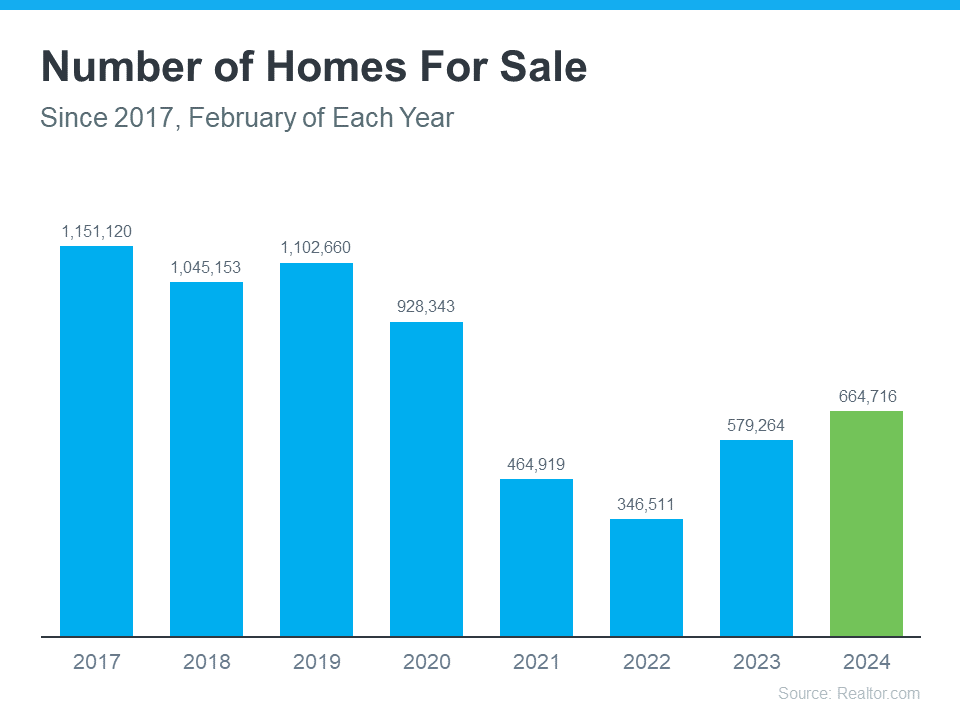

In a world that’s powered by data, a great agent can clarify what it all means, separate fact from fiction, and help you understand how current market trends apply to your unique search. From how quickly homes are selling to the latest listings you don’t want to miss, they can explain what’s happening in your specific local market so you can make a confident decision.

3. Explain Pricing and Market Value

Agents help you understand the latest pricing trends in your area. What’s a home valued at in your market? What should you think about when you’re making an offer? Is this a house that might have issues you can’t see on the surface? No one wants to overpay, so having an expert who really gets true market value for individual neighborhoods is priceless. An offer that’s both fair and competitive in today’s housing market is essential, and a local expert knows how to help you hit the mark.

4. Review Contracts and Fine Print

In a fast-moving and heavily regulated process, agents help you make sense of the necessary disclosures and documents, so you know what you’re signing. Having a professional that’s trained to explain the details could make or break your transaction, and is certainly something you don’t want to try to figure out on your own.

5. Bring Negotiation Expertise

From offer to counteroffer and inspection to closing, there are a lot of stakeholders involved in a real estate transaction. Having someone on your side who knows you and the process makes a world of difference. An agent will advocate for you as they work with each party. It’s a big deal, and you need a partner at every turn to land the best possible outcome.

Bottom Line

Real estate agents are specialists, educators, and negotiators. They adjust to market changes and keep you informed. And keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Expert advice from a trusted professional is priceless. Connect with a local real estate agent today.

Source: Keeping Current Matters

Follow

Follow

![Top 5 Reasons To Hire an Agent When Buying a Home [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240401/Top-5-Reasons-To-Hire-an-Agent-When-Buying-a-Home-KCM-Share.png)

![Outdoor Projects Can Boost Curb Appeal When You Sell [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240328/Outdoor-Projects-to-Boost-Curb-Appeal-When-You-Sell-KCM-Share.png)